garkamaalik 0 Comments 6 Views

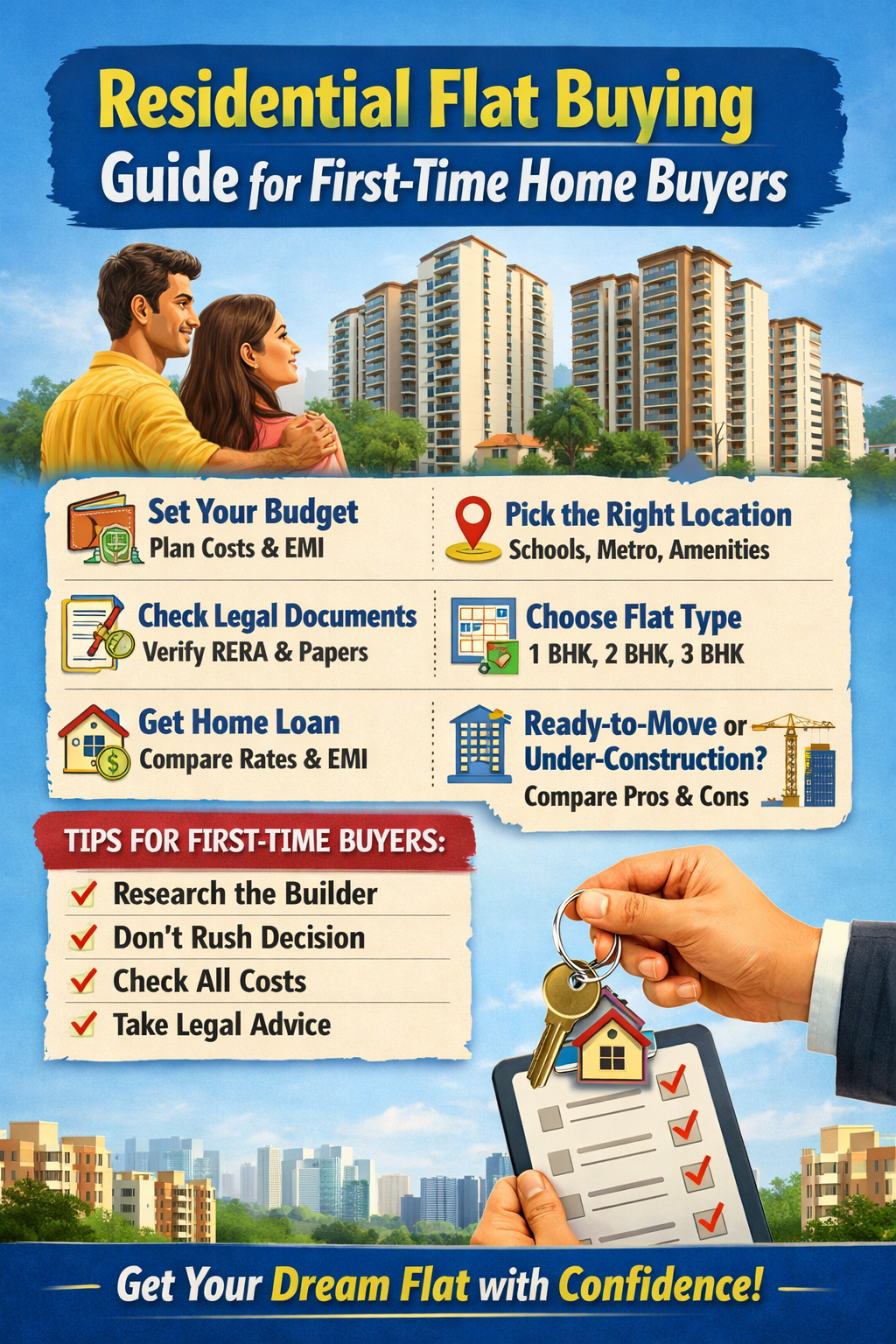

Residential Flat Buying Guide for First-Time Home Buyers

Residential Flat Buying Guide for First-Time Home Buyers

Buying your first residential flat is one of the most important financial decisions of your life. For first-time home buyers, the process can feel confusing due to legal checks, budget planning, home loans, and choosing the right location.

This guide will help you understand step-by-step how to buy a residential flat safely and smartly in India.

1. Set Your Budget Clearly

Before searching for flats, decide your total budget, including:

-

Flat cost

-

Registration & stamp duty

-

GST (if under-construction)

-

Maintenance charges

-

Parking & club charges

💡 Tip: Your home loan EMI should not exceed 30–40% of your monthly income.

2. Choose the Right Location

Location plays a big role in future value and lifestyle.

Check for:

-

Connectivity (metro, highways, public transport)

-

Nearby schools, hospitals & markets

-

Safety and water supply

-

Future development plans

📍 Metro-connected areas usually offer better resale and rental value.

3. Decide Flat Type & Size

Choose according to family needs:

-

1 BHK: Budget buyers / investment

-

2 BHK: Small families (most popular)

-

3 BHK: Growing families

Also check:

-

Carpet area (not just super built-up)

-

Ventilation & sunlight

-

Vastu (if important to you)

4. Check Builder Reputation

Always research the builder:

-

Past project delivery record

-

Construction quality

-

Customer reviews

-

RERA registration number

🔍 Visit the site personally and talk to existing residents if possible.

5. Verify Legal Documents (Very Important)

Before booking a flat, ensure these documents are clear:

-

RERA registration certificate

-

Approved building plan

-

Land title & ownership papers

-

Completion certificate (for ready flats)

-

Occupancy certificate

-

Sale agreement draft

⚠️ Never book a flat without RERA approval.

6. Home Loan & EMI Planning

Compare home loan offers from:

-

Banks

-

Housing finance companies

Check:

-

Interest rate (fixed or floating)

-

Processing fees

-

Prepayment charges

-

Loan tenure

📌 Maintain a good credit score (750+) for better interest rates.

7. Ready-to-Move vs Under-Construction

| Ready-to-Move | Under-Construction |

|---|---|

| Immediate possession | Lower price |

| No GST | GST applicable |

| Less risk | Higher appreciation |

Choose based on urgency & risk appetite.

8. Understand All Costs Clearly

Apart from flat price, ask about:

-

Maintenance charges

-

Parking cost

-

Electricity & water connection fees

-

Clubhouse / society charges

📄 Ask for a detailed cost sheet before final payment.

9. Registration & Possession

Once payment is done:

-

Register the flat in your name

-

Collect original documents

-

Take possession letter

-

Inspect the flat carefully

🛠️ Check plumbing, electrical fittings, doors & tiles before possession.

10. Tips for First-Time Buyers

✔ Don’t rush the decision

✔ Avoid emotional buying

✔ Compare at least 3 projects

✔ Keep all payments documented

✔ Take expert legal advice if needed

0 Comments